HELPING BORROWERS LOWER THEIR INTEREST RATE BY UP TO 2% AT THE START OF THEIR LOAN

We give our clients extra flexibility with a lower monthly payment by offering them a Temporary Rate Buydown to lower their interest rate at the start of their loan. It’s a great option for borrowers who expect an increase in their income in the next few years or who have excess seller concessions to use — and want to take advantage of a low fixed rate.

Available for:

- Conventional primary and second home purchases

- FHA and VA primary home purchases

Seller-paid 2-1 year buydown options

2-1 buydown means subtracting 2% from the full rate in the first year and subtracting 1% from the full rate in the second year. By the third year they are at the full rate.

The borrower must qualify for the full monthly payment (before the buydown rate is applied

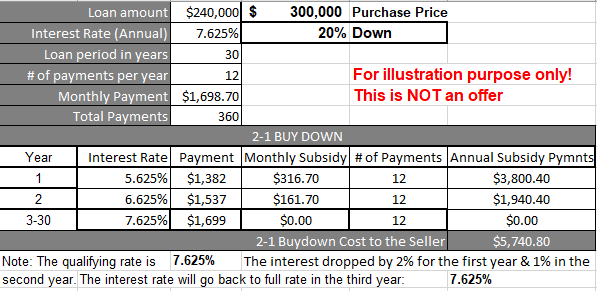

2-1 Buydown example (for illustration purpose only).

Assume a purchase price of $300K, single family, owner occupied, primary residence, 20% down, $240K loan amount, qualifying/full interest rate is 7.625% (APR 7.89%), assume a 740-credit score, full doc and 30 years term (360 payments). Seller contribution is $5,740.80 (see above)

The interest rate for the first year is 5.625%, the second year is 6.625% and the third year is going back to the qualifying/full rate, which is 7.625%. Monthly savings for the first year and the second year is $316.70 and $161.70 respectively.

As we all know that the interest rate has increased dramatically. As a result, many homebuyers are dropping out of the market. Therefore, temporary 2-1 buydown can be a great incentive to homebuyers to get a lower rate for a few years.

Seller’s contribution is required to get this program.